Nyngan Detailed Review

Property and Geologic Description

The Nyngan scandium resource is located approximately 500 kilometers northwest of Sydney, Australia. The property consists of two exploration licenses (part of EL 6009 and all of EL 6096). The property encompasses 2,925 hectares and is accessible via a 25 km sealed road from the local town of Nyngan.

The Nyngan scandium resource is located approximately 500 kilometers northwest of Sydney, Australia. The property consists of two exploration licenses (part of EL 6009 and all of EL 6096). The property encompasses 2,925 hectares and is accessible via a 25 km sealed road from the local town of Nyngan.

The scandium resource is hosted within the lateritic zone of the Gilgai Intrusion (Gilgai is the Aboriginal name given to the geologic formation), one of several Alaskan-type mafic and ultramafic bodies which intrude Cambrian-Ordovician metasediments collectively called the Girilambone Group. The laterite zone, locally up to 40 meters thick, is layered with hematitic clay at the surface followed by limonitic clay, saprolitic clay, weathered bedrock and finally fresh bedrock. The scandium mineralization is concentrated within the hematitic, limonitic, and saprolitic zones with values up to 495 ppm scandium over 12 meters.

Project History

The first systematic exploration in the region was conducted by Selection Trust in the late 1970's, followed in the 1980's by North Broken Hill. The companies were looking for gold and tin, respectively, and did not have encouraging results.

In the late 1980's, Lachlan Resources N.L., as manager of the "Platsearch Group", explored the area for platinum group metals (PGM). Lachlan conducted airborne and ground magnetic surveys to locate and delineate the intrusive "Alaskan-style" ultramafic complexes considered to be prospective for PGM. Subsequent broad-spaced RAB drilling identified platinum targets, and follow-up close-spaced RAB drilling (134 holes for 6,779 meters) and diamond drilling (2 holes for 500 meters) produced assay results showing peak values of 1.53 g/t Pt. Some pyroxinite bedrock samples showed scandium levels of over 100 ppm. Lachlan dropped the properties in the mid 1990's, which were subsequently picked up by Anaconda. Anaconda focused on nickel/cobalt enrichment in laterites, completed considerable ground magnetic traversing, drilled 54 RC holes (2,302 meters) and dropped the ground in 2001.

Jervois Mining Limited, of Melbourne, Australia ("JRV") (ASX Ticker : JRV) was able to obtain the pulps from the Anaconda RC drill program and analyzed them for numerous minerals, including scandium. Those initial assay results confirmed significant scandium enrichment in the Gilgai laterites. JRV secured the available exploration licenses and completed an RC drill program in 2006 (64 RC holes for 2,638 meters) from which Douglas McKenna & Partners produced a JORC compliant resource.

Nyngan Scandium Project - Flowsheet Development

The Company has invested in and developed methodology for extracting scandium from the Nyngan property resource since 2010. A portion of the work done over this period has been superseded by work that followed, but subsequent test programs universally benefitted from prior efforts. In summary, the programs have been as follows:

- 2010 - The Company inherited work done on Nyngan from Jervois, and applied that work to a quick flowsheet and capital estimate prepared for management by Roberts & Schaefer of Salt Lake City, Utah;

- 2011 - The Company employed Hazen Research, Inc., of Golden, Colorado, USA ("Hazen") to test acid baking techniques and solvent extraction ("SX") processes with Nyngan resource material. The Company also employed SGS-Lakefield (Ontario) to test pressure acid leach techniques on Nyngan resource, as a replacement for or an enhancement to acid bake techniques done earlier in the year by Hazen;

- 2012 - The Company engaged SNC-Lavalin to do an economic study for management, utilizing an acid bake flowsheet and SX work from the Hazen test program;

- 2014 - The Company published a preliminary economic assessment ("PEA") entitled NI 43-101F1 Technical Report on the Feasibility of the Nyngan Scandium Project, authored by Larpro Pty Ltd, utilizing both Hazen and SGS-Lakefield testwork results; and

- 2015 - The Company amended and refiled the 2014 PEA Report as the "Amended Technical Report and Preliminary Economic Analysis on the Nyngan Scandium Project, NSW, Australia".

Nyngan Definitive Feasibility Study

During May 2016 the Company issued a National Instrument NI 43-101 Technical Report entitled "Feasibility Study - Nyngan Scandium Project". The feasibility study was independently prepared.

Lycopodium Limited, (ASX:LYL) led the feasibility study from their Brisbane, Australia office with supporting input from Mining One of Melbourne, Australia, Knight Piésold of Brisbane, Australia, Altrius Engineering Services of Brisbane, Australia, and Rangott Mineral Exploration Pty Ltd of Orange, Australia.

The feasibility study confirms the commercial viability of both the resource and the process for recovering scandium, as configured, for the Nyngan Project. The Nyngan resource has now been expanded by 40% compared to the prior estimate, a 20 year project mineable grade has been defined through a detailed mine plan, and the processing facility has been configured and is supported by detailed flowsheet test work. Based on the results of the feasibility study, the technical team led by Lycopodium has recommended that the Project owners seek project financing and proceed to construction.

The feasibility study confirms the commercial viability of both the resource and the process for recovering scandium, as configured, for the Nyngan Project. The Nyngan resource has now been expanded by 40% compared to the prior estimate, a 20 year project mineable grade has been defined through a detailed mine plan, and the processing facility has been configured and is supported by detailed flowsheet test work. Based on the results of the feasibility study, the technical team led by Lycopodium has recommended that the Project owners seek project financing and proceed to construction.

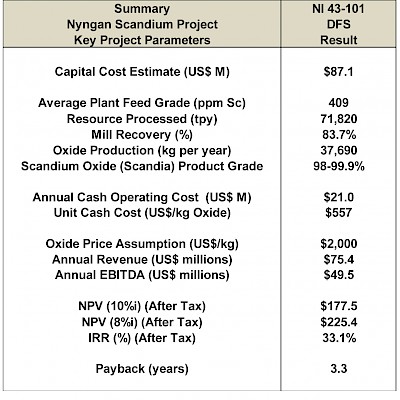

FEASIBILITY STUDY HIGHLIGHTS:

- Capital cost estimate for the Project is US$87.1 million,

- Operating cost estimate for the Project is US$557/kg scandium oxide,

- Oxide product volume averages 37,690 kg per year, over 20 years,

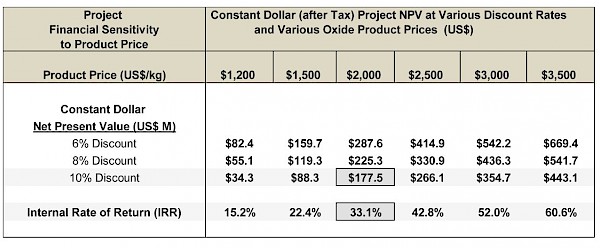

- Project Constant Dollar NPV10% is US$177 million, (NPV8% is US$225 million),

- Project Constant Dollar IRR is 33.1%,

- Oxide product grades of 98-99.9%, as based on customer requirements,

- Project resource increases by 40% to 16.9 million tonnes, grading 235ppm Sc, at a 100ppm cut-off in the measured and indicated categories, and

- Project Reserve totalling 1.43 million tonnes, grading 409ppm Sc was established on part of the resource.

PROJECT OVERVIEW

The feasibility study concludes that the Project has the potential to produce an average of 37,690 kilograms of scandium oxide (scandia) per year, at grades of 98.0%-99.9%, generating an after tax cumulative cash flow over a 20 year Project life of US$629 million, with an NPV10% of US$177 million. The average process plant feed grade over the 20 year Project life is 409ppm of scandium.

The financial results of the feasibility study are based on a conventional flow sheet, employing continuous high pressure acid leach (HPAL) and solvent extraction (SX) techniques. The flow sheet was modeled and validated from METSIM modeling and considerable bench scale/pilot scale metallurgical test work utilising Nyngan resource material. A number of the key elements of this flowsheet work have been protected by the Company under US Patent Applications.

The feasibility study has been developed and compiled to an accuracy level of +15%/-5%, by a globally recognized engineering firm that has considerable expertise in laterite deposits and process facilities, as well as in smaller mining and processing projects, and has excellent familiarity with the Project location and environment.

Project Financial Highlights and Key Assumptions

The feasibility study finds that the Project has the potential for attractive economics, based on a capital estimate supported by conventional process designs and direct vendor pricing. The feasibility study is expressed in US dollar (US$) currency, unless otherwise noted. A foreign exchange rate of US$0.70 (1A$=US$0.70) was applied in all conversions. No escalation for inflation was assumed in cash flows. All cash flows and discounted cash flows (NPVs and IRRs) in this news release are shown on an after-tax basis, based on a 30% Australian corporate tax rate.

Highlights and key assumptions are as follows:

Nyngan Scandium Project - Feasibility Study Financial Highlights

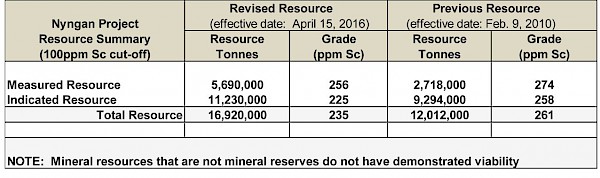

Mineral Resource Estimate

The feasibility study includes a revised and updated resource estimate for the Nyngan Scandium Project, originally established in 2010. The revised NI 43-101 Measured and Indicated scandium resource now totals 16.9 million tonnes at an average grade of 235ppm scandium, from all scandium-bearing sources including hematite, limonite, saprolite and some bedrock resource material. The updated resource retains the same economic cut-off value of 100ppm as was used in the earlier resource estimate. The new resource was established using Gemcom's SURPAC Block Model software and applied Ordinary Kriging techniques for estimation.

The feasibility study production plan is based on a portion of the new limonite-only resource, and provides a 20 year mining program consisting of two production pits, sufficient to supply the processing plant at a (nameplate) rate of 75,000 tpy and an average grade of 409ppm scandium over the life of the Project. Both the new resource estimate and the 20 year mining pit design are based on assay and lithology data from a property total of 141 drill holes, including assay and lithology data from recent (2014-2015) drilling work.

The updated and original Nyngan Project scandium mineral resources are as follows:

Nyngan Scandium Resource

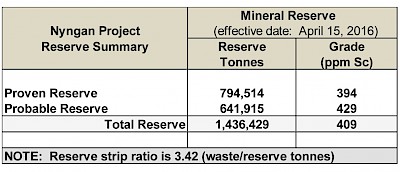

Mineral Reserve Estimate

The feasibility study includes the first established Reserve on a portion of the resource, associated specifically with that portion of the limonite resource on which economic viability has been established by the engineering and project development work in the feasibility study. The feasibility study utilizes 1.34 million tonnes of limonite resource over 20 years, almost all in the Measured Resource category, and that portion of the overall resource has generated the Reserve figure, as shown below:

Nyngan Scandium Reserve

Mining and Processing Summary

The mining element of this Project has always represented a relatively minor part, although a critical part, of the overall Project activity. The feasibility study mine plan is based on a plant feed of 240 tonnes/day (tpd) or 75,000 tonnes per year requirement. Mine production is based on conventional open pit methods with an average strip ratio of 2.1:1 (overburden/resource). The mine will be worked in campaigns, likely 3 one-month production periods per year, avoiding the wet months, in which a contract miner will be employed to extract and deliver material to a run-of-mine plant stockpile adjacent to the processing facility. The processing plant will run continuously, fed from plant stockpiles of previously mined resource, covered against moisture and weather.

The processing plant operations will size the input material, and then initially apply a high pressure acid leaching (HPAL) system, using a continuous autoclave pressure-fed with pre-heated ore, dosed with sulfuric acid. Subsequent circuits will then recover the liberated scandium using solvent extraction (SX), oxalate precipitation and calcination, to generate a finished scandium oxide product. Once at nameplate capacity, the processing plant is forecast to produce between 36,600 and 42,000 kilograms of scandium oxide product per year, averaging 37,690 kilograms/year over the 20 year feasibility study production period. Oxide product will be produced on-site at grades between 98% and 99.9%, as Sc2O3, and will be offered at grades that meet various customer requirements, suitably packaged for direct sales to end users.

Plant tailings will be neutralized with lime to pH 8.5, dewatered, and stored in a Residue Storage Facility (tailings pond) meeting the environmental requirements of mining permits and NSW State regulators. Overall environmental programs covering the 20 year production life of the Project, as outlined in the feasibility study, will be documented in an Environmental Impact Statement ("EIS"), which is currently in development for submission to NSW governmental authorities.

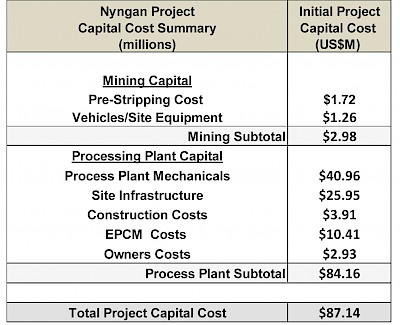

Capital Cost Detail

Total capital costs for the Project are estimated at US$87.1 million, and include a 10.5% contingency, allocated on a line item basis varying from 5% to 15%, depending on estimation method, vendor quotation details, and Lycopodium's risk assessment for the capital cost area. The majority (87%) of the capital cost in the feasibility study was Australian-sourced, and consequently initially priced in Australian dollars (A$). The capital cost estimate is established at a +15%/-5% level of accuracy, consistent with industry standards for a Definitive Feasibility Study.

The initial capital cost is spread over a number of areas, but the high pressure autoclave systems (HPAL), leaching and neutralization circuits contained in the processing plant are the most significant capital items, totalling US$41M or 47% of total costs, including contingencies.

Sustaining plant and operations capital is provided as an annual expensed cost, and totals US$3.6M over the life of the project. Sustaining tailings pond capital is similarly provided for and expensed annually to operating costs, and totals US$22.4M, over the life of the project. These costs are treated as cash unit production costs, where those figures are provided.

The cash flow model includes US$5.2M in costs for tailings pond closure, expensed one year after the final year of operation, which is 2038. The pond will likely have reached its optimal size at this time, and would need to be rehabilitated in any event. The model does not include any costs for demolition of facilities, or recovery of value for equipment or facilities in the form of salvage. The feasibility study authors did not undertake detailed investigations of alternate site uses for the project facility after 20 years, because the Measured and Indicated scandium resource is considerably larger than the current project would consume, allowing for either expansions of capacity, extensions of the 20-year initial time period of operation, or both.

Feasibility Study Capital Cost Detail

Operating Costs Detail

Operating costs were estimated based on metallurgical test work results and METSIM modelling quantities and requirements. The single most significant cost item in operating costs is reagent cost, with the single largest component in this category being sulfuric acid. The acid price used was A$270/tonne, as quoted by a sulfuric acid broker, delivered to site. The second most significant cost is staff/labor, where the feasibility study assumes a staffing level of 73 full time personnel. The level of accuracy on the operating component was estimated at +15%/- 15%.

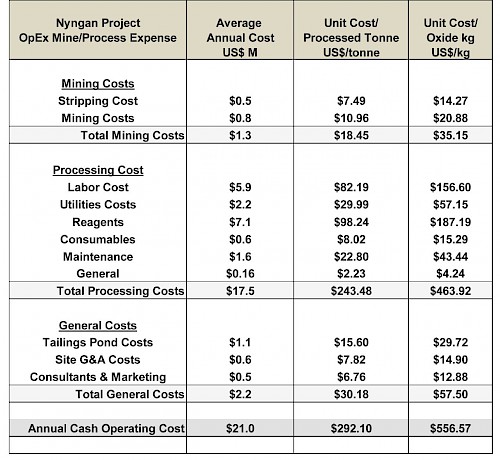

Operating cost details in the feasibility study, as to total average annual cash costs, and also unit costs on an annual average ore tonnage throughput basis and a kilogram oxide basis, are as follows:

Feasibility Study Operating Costs, and Unit Costs Per kg Oxide

The Project plan has provided for a gradual ramp-up to full (nameplate) capacity in the first two years of operation. The ramp-up provides for 35% of nameplate throughput (26,250 tonnes) in production year 1 (2018) and 80% of nameplate throughput (60,000 tonnes) in production year 2 (2019). The respective scandium oxide product output estimate during those years is 13,300kg and 30,900kg, respectively. This 2 year ramp-up to nameplate capacity was determined based on the commissioning experience of other HPAL plants of similar general design, built and brought online in the last 15 years. All of these benchmarking examples were nickel plants processing lateritic ores, all but one were initial installations, and all were of much bigger size than the Nyngan processing plant.

Pricing Assumptions

The price assumption in the feasibility study is US$2,000 per kilogram (kg) of scandium oxide product, as an average price covering all product sold, over various product grades. Current market pricing, such as that can be established, is substantially above these levels based on small unit quantities and varying grades. This product pricing benchmark applied in the feasibility study remains the same as was applied in the 2014 Preliminary Economic Assessment ("PEA") on this Project, and for the same reasons. In order to encourage a viable, over-subscribed and vigorous scandium market, across numerous applications, product suppliers will need to provide for adequate supply of quality product, available from trusted jurisdictions, at prices lower than product trades for today.

In addition to limited publically available price quotes for scandium oxide, the feasibility study notes two other reference points on the US$2,000/kg price assumption. The Company has an offtake agreement in place, for 7,500 kg/year (3 years), with pricing being supportive of the pricing assumption in the feasibility study. The customer is a knowledgeable alloy group, with longstanding interest in aluminum-scandium alloys. The feasibility study price assumption is also supported by a recent, independent marketing report that examines the 10 year scandium supply/demand outlook, and includes scenario-based 10 year price forecasts. The details and contents of this market outlook report will remain confidential, but select information will be included in the feasibility study. Both of these reference points support that the scandium value proposition for customers/consumers is valid at this price level.

Sensitivities

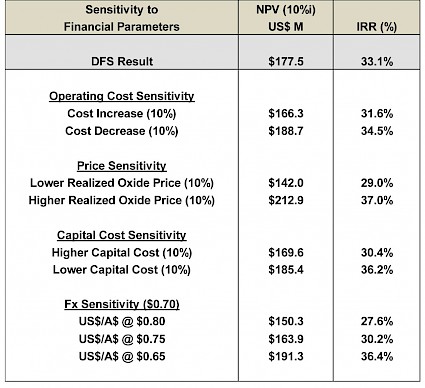

The project is most sensitive to changes in the value of the Australian dollar relative to the US dollar, along with changes in the product price. The Project is somewhat less sensitive to either operating or capital cost changes. Sensitivities to various parameters are shown below.

Sensitivity to Product Price

Profitability Sensitivities to Changes in Key Financial Assumptions

General Assumptions

The feasibility study is presented on a 100% ownership basis. The Company effectively owns 80% of the Project through its 80%-owned Australian subsidiary, EMC Metals Australia Pty Ltd. The remaining 20% of EMC Australia Pty Ltd is owned by Scandium Investments LLC, a Nevada corporation owned by private interests.

All cash flows and financial analyses have been presented on a 100% equity basis. No debt leverage has been assumed in providing capital for development. No inflation factors have been applied to future cash flows, making the discounted cash flow performance measures constant dollar figures.

The Project schedule identifies 2017 as the initial year in the cash flow, with construction initiated and completed in that year. Some commissioning is scheduled for Q4 2017. Further wet commissioning and start-up is scheduled for Q1 2018. First production is planned for March 2018, which is year 1 of 20 (calendar) years of production, completing in 2037. Reclamation of the Residue Storage Facility is scheduled for 2038. The supply and delivery estimate on the specialist autoclave and flash vessels is setting the timeframe for first production in Q1 2018.

Conclusions And Recommendations

The production assumptions in the feasibility study are backed by solid independent flow sheet test work on the planned process for scandium recovery. The report consolidates a significant amount of metallurgical test work and prior study on the Project, including important test work results completed since the PEA was generated in 2014. The entire body of work demonstrates a viable, conventional process flow sheet utilizing a continuous-system HPAL leaching process, and good metallurgical recoveries of scandium from the resource. The metallurgical assumptions are supported by various bench and pilot scale independent test work programs that are consistent with known outcomes in other laterite resources. The continuous autoclave configuration, as opposed to batch systems explored in previous flow sheets, is also a more conventional and current design choice.

The level of accuracy established in the feasibility study substantially reduces the uncertainty levels inherent in earlier studies, specifically the PEA. The greater confidence intervals around this Technical Report are achieved by reliance on significant project engineering work, a capital and operating cost estimate supported by detailed requirements and vendor pricing, plus one offtake agreement and an independent marketing assessment, both supportive of the marketing assumptions on the business.

The feasibility study delivers a positive result on the Nyngan Scandium Project, and recommends the Project owners seek finance and proceed to construction. Recommendations are made for additional immediate work, notably to win additional offtake agreements with customers, complete some optimizing flow sheet studies, and to initiate as early as possible detailed engineering required on certain long-lead capital items.

Nyngan Environmental Impact Statement ("EIS")

During May 2016 the Company announced that an Environmental Impact Statement ("EIS") was filed with the New South Wales Department of Planning and Environment, (the "Department") in support of the planned development of the Nyngan Scandium Project.

The EIS was prepared by R.W. Corkery & Co. Pty. Limited, on behalf of EMC Metals Australia Pty Ltd ("EMC Australia") to support an application for Development Consent for the Nyngan Scandium Project, located approximately 20km west-southwest of the town of Nyngan in Western NSW, Australia. The EIS is a complete document, including a Specialist Consultants Study Compendium, and was submitted to the Department on Friday, April 29, 2016. The EIS will receive a compulsory adequacy review by Department staff and other relevant government agencies as a condition to formal acceptance and public availability.

The EIS was submitted by EMC Australia, the Company's 80% owned Australian subsidiary. EMC Australia holds 100% of the Nyngan Scandium Project.

EIS HIGHLIGHTS:

- The EIS finds residual environmental impacts represent negligible risk,

- The proposed development design achieves sustainable environmental outcomes,

- The EIS finds net-positive social and economic outcomes for the community,

- Nine independent environmental consulting groups conducted analysis over five years, and contributed report findings to the EIS,

- The Nyngan Project development is estimated to contribute A$12.4M to the local and regional economies, and A$39M to the State and Federal economies, annually.

- The EIS is fully aligned with the Feasibility Study.

Conclusion Statement in the EIS:

Conclusion Statement in the EIS:

"In light of the conclusions included throughout thisEnvironmental Impact Statement, it is assessed that the Proposal could be constructed and operated in a manner that would satisfy all relevant statutory goals and criteria, environmental objectives and reasonable community expectations."

The EIS is the foundation document submitted by a developer intending to build a mine facility in Australia. The Nyngan Project is considered a State Significant Project, in that capital cost exceeds A$30million, which means State agencies are designated to manage the investigation and approval process for granting a Development Consent, from the Minister of Planning and Environment. The Minister's Department manages the review of the Proposal through a number of State and local governmental agencies.

The EIS is a self-contained set of documents used to seek a Development Consent. It is, however, supported in many ways by the Feasibility Study.

On November 10, 2016 the Company announced that the Development Consent had been granted. This Development Consent represents an approval to develop the Nyngan Scandium Project and is based on the EIS. The Development Consent follows an in-depth review of the EIS, the project plan, community impact studies, public EIS exhibition and commentary, and economic viability, and involved more than 12 specialized governmental agencies and groups.

During May 2017, EMC Australia received notice of approval for its Mining Lease application. The Mining Lease ("ML") overlays select areas previously covered by two Exploration Licenses. The ML represents the final major development approval required from the NSW Government to begin construction on the project. The ML is awarded after all environmental work has been completed and reviewed, all social implications of project development have been considered, and the NSW Environmental Minister has issued a Development Consent, which was received earlier, in November 2016. The ML grant reflects the further review that the State resource value has been considered and approved for extraction based on mine development plans. The ML is issued for a period of 21 years, and is based on the development plans and intent submitted in the ML Application. The ML can be modified by NSW regulatory agencies, as requested by EMC Australia over time, to reflect changing operating conditions.

In addition to these two key governmental approvals, other required licenses and permits must be acquired but are considered routine and require only compliance with fixed standards and objective measurements. These remaining approvals include submittal of numerous plans and reports supporting compliance with Development Consent and Mining Lease. In addition, the following water, roads, dam and electrical access reviews and arrangements must be finalized:

- Water Supply Works and Use Approval and Water Access License,

- State and local approval for construction of the intersection of the Site Access Road and Gilgai Road,

- An approval from the NSW Dams Safety Committee for the design and construction of the Residue Storage Facility, and

- A high voltage connection agreement with Essential Energy.

The Company intends to continue to follow and support the progress of governmental agency reviews.